Cashless Banking

We all recall the euphoria we felt when we opened our first transactional (non-savings) bank account. For many of us, it was only until our early twenties until this happened.

That wonderful feeling of being able to own, manage, and move funds was however short-lived. We then got bombarded by multiple costs such as service fees, transfer charges, inconvenient waiting queues, withdrawal charges. And in some extreme cases, a deposit charge!

As you will see from other posts, we are not entirely fans of the banking system, and to be frank, that is why the new blockchain technology fascinates us.

The case for mobile banking

We did, however, stumble across a (mobile) bank that ticks a lot of boxes when it comes to security, charges but more so, on the convenient side of things especially for freelancing.

Since discovering the N26 Bank, we were able to open an account (which took just minutes from the comfort of a dining room table).

As it is mobile, you have no need to stand in a line at a branch for money. There is also no worry about whether the ATM close-by will charge you extra to withdraw cash because it was a different institution.

Best of all – the grocery shopping experience! It is a breeze with full touch-device and smartcard functionality. With a quick touch of your card to the teller machine, the need to remember a code, punch it in, or sign for purchases are things of the past.

Granted, many retail banking institutions also offer mobile-banking services with a ‘touch card’ capability. This bank, however, adds that extra bit of practicality by incorporating credit card-like facilitates (and a CVV number). This allows you to shop online easily using services like GooglePay and ApplePay.

So what are the benefits?

So, you can now easily order and pay for items online. You can also make bookings for traveling, get your favourite game, watch and book shows, and events – and even easily purchase Cryptocurrency if you are into that as well. The main difference is that it has the functionality and benefits of using a debit card online.

Online banks are at the forefront to benefit from digital currency trading via the convenience they provide

There are many more benefits to using a mobile (digital) bank. As an advocate for practicality, we will only mention the ones that benefit you directly.

One advantage is transparency in managing both personal and business finances. You can open savings and investment portfolios within the app, and apply directly for instant credit or loans. Naturally, success in getting a loan is based on your monthly transactions and neatly categorized budget.

The tracking of revenue versus expenses is presented beautifully in an easy-to-understand format on the app. This naturally applies to payments made and received.

This inadvertently also saves you more in money and time it would have taken to print out bank statements, book tedious appointments.

The whole concept of bank branches is restrictive and now outdated. You can even draw and deposit money at some selected grocery stores. No more having to wait for banks to open or rushing to get to it before it closes. All this happens without a plastic card – just your Smartphone!

Other perks include:

- In-app security features – setting limits quickly and easily from the app to help you curb spending sprees.

- Instant money sending – with MoneyBeam you can send, receive, or request money from your friends instantly.

- Instant push notifications – get notified on all account activity.

- Log in using your fingerprint – for phones that have the feature, you have this extra and secure way other than the use codes, and pattern logins.

- Export your transactions – to CSV to import elsewhere for deeper analysis. This is useful for preparing business financial statements.

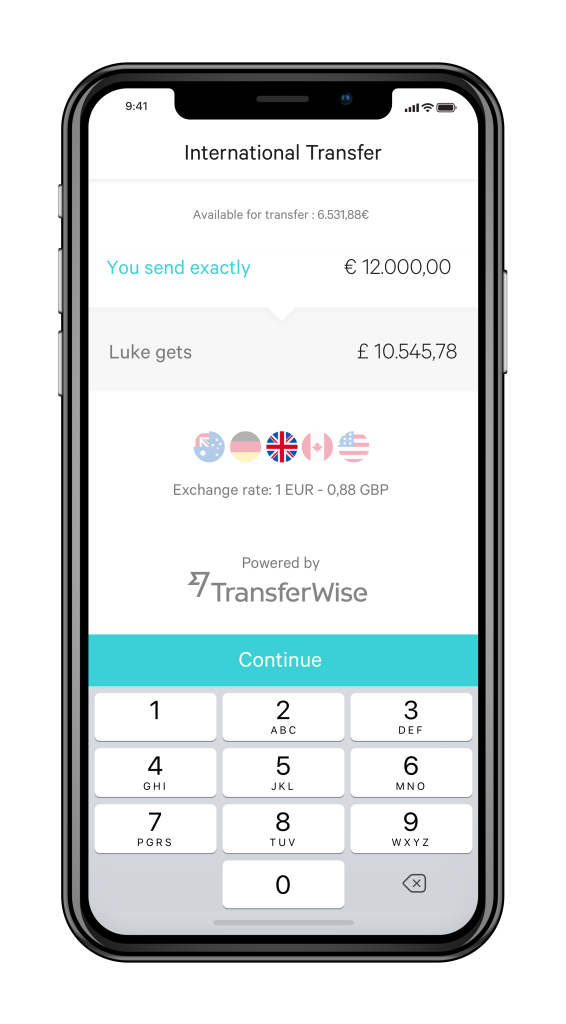

- International transfers – you can now with the help of their partner Transferwise, send money instantly to people abroad – all from the comfort of your phone or PC.

- Quick in-app support – chat with an agent via the inbuilt messaging system about an issue you are facing. They will respond quickly.

N26 Bank is backed by reputable institutions so they can only grow and expand offers further abroad despite being based in Berlin, Germany.

Anyone can open an N26 Bank account, as long as you are resident in the EU or EEA. In order to open an account, you would still need a mailing address in one of the countries where N26 operates for them to send you your debit/Mastercard – for touch services.

We await more of such developments and expansion into other countries -continents but for the time being, it fully serves our local needs.

Opening the account is easy:

1. Fill out the online registration form;

2. Complete an ID verification;

-If you live outside Germany: ID verification is carried out by taking a selfie and a photo of your ID through the app or;

-If you reside in Germany*: ID verification would be through an in-app video call.

3. Pair a smartphone with your account and you are good to go in about 10mins!

Click on the card below to set up your new N26 account